The global modest fashion market is no longer a niche; it is a powerhouse projected to reach nearly $500 billion by 2028. For brand owners, boutique buyers, and fashion designers, the challenge has shifted from “finding demand” to “securing a supply chain.”

In the garment manufacturing industry, not all suppliers are created equal. Some are traders (great for ready-stock), others are marketplaces (great for variety), and a select few are true manufacturers (essential for building a private label).

Drawing on the latest industry forecasts and regional advantages, we have curated the top 10 reliable modest clothing suppliers & manufacturers for 2026.

Top 10 Modest Clothing Suppliers & Manufacturers

| Supplier | 위치 | Best For (USP) | 웹사이트 |

|---|---|---|---|

| 항저우 의류 | 중국 | Private Label (OEM), Custom Design, Low MOQ | hangzhou-garment.com |

| Modanisa | Turkey | Trend Variety, Established Brands | modanisa.com |

| Fimka Stores | Turkey | Bulk Ready-to-Wear, Video Shopping | fimkastore.com |

| Al Haram London | UK | Basic Islamic Essentials, EU Logistics | alharamlondon.com |

| East Essence | USA | Affordable Basics, Inclusive Sizing | eastessence.com |

| Sefamerve | Turkey | Hijabs, Budget-Friendly Apparel | sefamerve.com |

| Shukr | Jordan/UK | Premium Natural Fabrics, Ethical Focus | shukronline.com |

| Aab Collection | UK | Luxury Minimalist Design | aabcollection.com |

| MyBatua | India | Embroidery, Occasion Wear | mybatua.com |

| Kabayare | USA | Urban/Youth Trends | kabayarefashion.com |

Hangzhou Garment (China)

- Founded: 2009

- Headquarters: Guangzhou, China

- Employee: ~80 Professionals (Specialized Design & Production Teams)

Specific Description:

Hangzhou Garment (Guangzhou Hangzhou Garment Co., Ltd.) stands out as the ideal strategic partner for mid-to-high-end fashion brands seeking Custom Manufacturing (OEM/ODM) rather than generic resale. Unlike inventory-based wholesalers, this factory solves the primary pain point for emerging brands: the inability to find high-quality production for small orders.

Located in Guangzhou, the epicenter of the global fabric supply chain, they offer rapid access to premium materials like Chiffon, Linen, 명주, and organic sustainable fabrics. Their technical advantage lies in their “Small Batch, Fast Response” model. They support a low Minimum Order Quantity (MOQ) of 100-200 pieces per color, with a lightning-fast 3-5 day sampling turnaround.

Crucially, they are the “backend engine” for brands demanding ethical standards. With BSCI and SMETA certifications and a monthly capacity of 60,000 units, they ensure strict quality control—from high-temperature shrinkage to color-checking—allowing you to launch unique, high-quality collections without heavy capital investment.

Modanisa (Turkey)

- Founded: 2011

- Headquarters: Istanbul, Turkey

- Employee: 500-1,000

Specific Description:

Modanisa is the undeniable giant of the modest fashion world. While primarily known as a B2C e-commerce platform, its influence dictates global trends. For wholesalers, Modanisa serves as a massive aggregator of Turkish fashion labels. Their strength is variety and trend-setting. They carry over 650 brands and 70,000 products, shipping to 140 countries. While they are not a custom manufacturer for private labels, they are an excellent source for retailers looking to stock established Turkish brands that already carry consumer recognition. Their logistics network is highly developed, offering relatively fast shipping from Istanbul to Europe and the Middle East.

Fimka Stores (Turkey)

- Founded: 1984

- Headquarters: Istanbul, Turkey (Laleli District)

- Employee: 200-500

Specific Description:

Fimka represents the traditional “Laleli Wholesale” model modernized for the digital age. They are a pure B2B wholesale distributor specializing in ready-to-wear inventory. Their technical differentiator is their “Video Shopping” capability and No MOQ policy for showroom visits. This allows buyers to visually inspect fabrics and drape via video call and ship goods immediately. Fimka is best suited for boutiques that need to restock “fast fashion” items (tunics, abayas, plus-size suits) instantly and cannot afford the lead time of custom manufacturing. They act as a bridge to over 30 different Turkish manufacturers.

Al Haram London (UK)

- Founded: Est. early 2000s

- Headquarters: London, United Kingdom

- Employee: 10-50

Specific Description:

Al Haram London functions as a critical logistics hub for the European market. They specialize in Islamic essentials—Abayas, Jilbabs, and Prayer Sets. Their competitive advantage is geography; for UK and EU-based retailers, sourcing from Al Haram eliminates the complexity of customs clearance and long sea freight times associated with Asian imports. Their product lines are generally more traditional and basic compared to the high-fashion Turkish brands, making them the go-to supplier for “bread and butter” inventory: staple items that sell year-round with consistent demand.

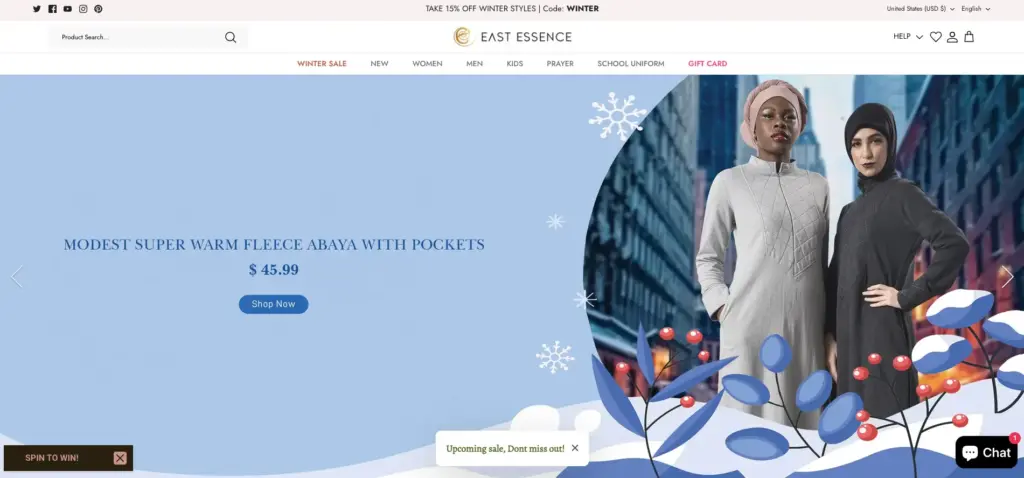

East Essence (USA)

- Founded: 2007

- Headquarters: Newark, California, USA

- Employee: 201-500

Specific Description:

East Essence has dominated the North American market by focusing on utility and affordability. They are technologically distinct for their focus on inclusive sizing (offering extensive plus-size ranges) and school uniforms. For US-based drop-shippers or retailers, East Essence provides a localized warehousing solution that drastically cuts shipping times compared to overseas vendors. While their designs are typically conservative basics rather than trend-led fashion, their reliable stock levels and understanding of the Western Muslim consumer’s need for practical, everyday wear make them a stable partner.

Sefamerve (Turkey)

- Founded: 2012

- Headquarters: Istanbul, Turkey

- Employee: 200-500

Specific Description:

Sefamerve is a direct competitor to Modanisa but with a distinct specialization in Headscarves (Hijabs) and budget-friendly apparel. They have a massive production footprint in the hijab category, offering thousands of SKUs in fabrics ranging from cotton voile to Medina silk. Their business model relies on high volume and low margins. For retailers whose primary revenue stream comes from accessories or entry-level price point clothing, Sefamerve offers the scale needed to maintain healthy profit margins. They are particularly strong in logistics to European countries with large Turkish diasporas.

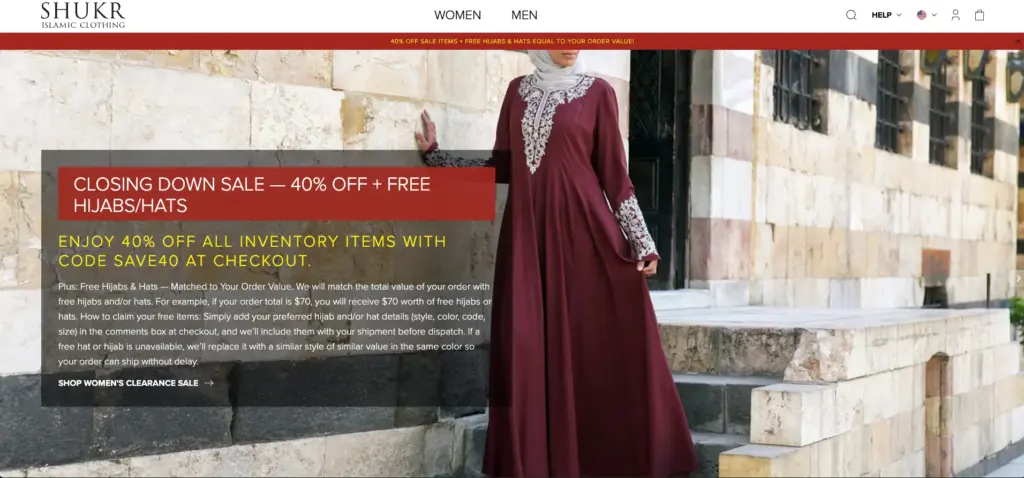

Shukr (Jordan/UK/USA)

- Founded: 2001

- Headquarters: Amman, Jordan (Operations in UK/USA)

- Employee: 51-200

Specific Description:

Shukr is the industry benchmark for “Modern Modest” quality. Unlike many competitors who rely on polyester, Shukr differentiates itself through the use of premium natural fabrics like denim, cotton, linen, and rayon. Their manufacturing process emphasizes higher stitch counts and durability. They appeal to a specific demographic: Western Muslims who want contemporary, non-traditional designs that adhere to Islamic principles. For high-end boutiques, carrying or emulating the quality of Shukr products signals a commitment to ethical labor practices and sustainable fashion.

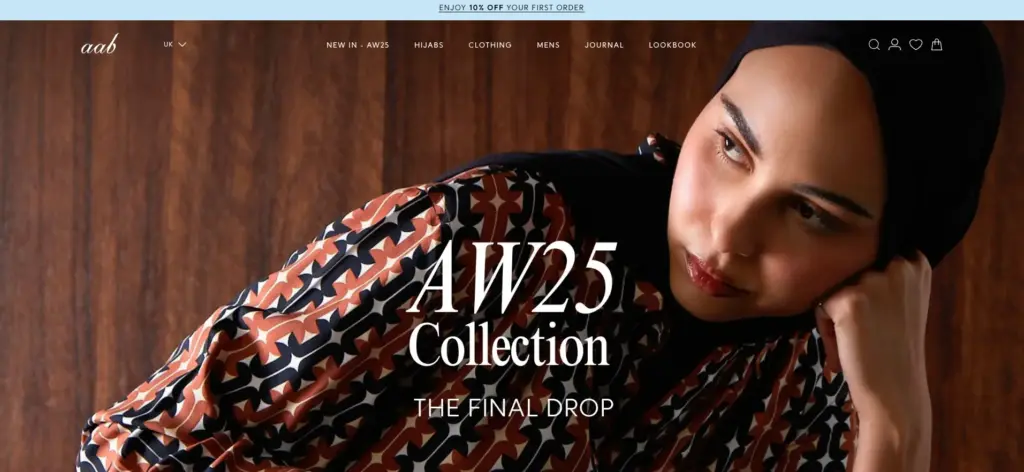

Aab Collection (UK)

- Founded: 2007

- Headquarters: London, United Kingdom

- Employee: 10-50

Specific Description:

Aab Collection is a pioneer in the Premium/Luxury High Street segment. They were among the first to bring a clean, minimalist, Scandinavian-inspired aesthetic to modest fashion. While primarily a B2C retailer, they set the design standard for the industry. Their products feature sophisticated tailoring and high-GSM fabrics. Industry buyers often look to Aab to understand the direction of “luxury modest” trends. They represent the upper echelon of the market, where design intellectual property and brand prestige command higher prices.

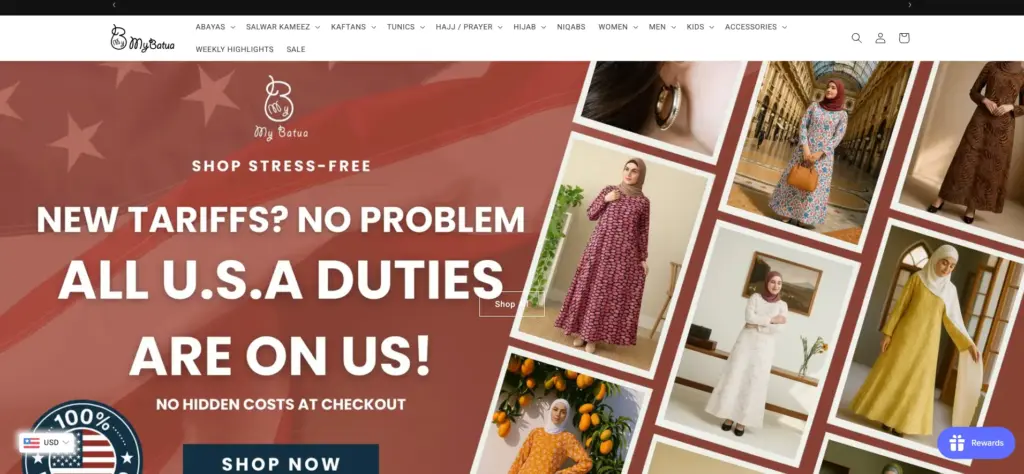

MyBatua (India)

- Founded: 2010

- Headquarters: New Delhi, India

- Employee: 50-200

Specific Description:

MyBatua leverages India’s rich textile heritage to offer a distinct advantage: intricate hand-embroidery and embellishment at a competitive price point. While Turkey rules the “modern casual” space, India dominates the “heavily detailed” niche. MyBatua is an excellent source for Abayas and Kaftans that feature zari work, beadwork, or sequins, which would be cost-prohibitive to manufacture in Europe or the US. They are a preferred supplier for retailers targeting ethnic niche markets or wedding/occasion wear consumers.

Kabayare (USA)

- Founded: 2011

- Headquarters: Seattle, Washington, USA

- Employee: 10-50

Specific Description:

Kabayare has successfully captured the Gen Z and Millennial market by merging modest requirements with urban American trends. Their technical strength is their agility in social media marketing and trend adaptation. They move away from traditional black abayas into vibrant prints, layered trench coats, and stylish maxis that fit a “city chic” aesthetic. For buyers looking to attract a younger demographic that views modesty as a fashion statement rather than just a religious obligation, Kabayare’s catalog offers the right visual language.

Key Factors to Consider When Choosing Your Supplier

- Customization vs. Ready Stock: If you want to build a long-term brand asset, custom manufacturing (OEM) is superior to simply reselling wholesale stock. It allows you to control the quality, labeling, and design.

- Ethics & Certifications: Modern consumers care about who made their clothes. Partners like Hangzhou Garment who hold SMETA and BSCI certifications give your brand a credible “ethical fashion” narrative to tell.

- Speed & Flexibility: In the fashion world, timing is everything. Look for suppliers who can offer quick sample turnarounds (under 1 week) so you can test trends without over-committing capital.

Why China Remains the Top Choice for High-Quality Custom Clothing

Although Turkey is often recognized for its fashion design and closeness to Europe, China continues to lead the world in manufacturing supply chains. The main advantage of Chinese manufacturing is its concentration. In major cities like Guangzhou, a clothing factory does not work alone. Instead, it operates within a short distance of suppliers for fabrics, dyes, and accessories. This close network allows manufacturers to produce complex designs, such as detailed embroidery or custom colors, much faster and more accurately than in other parts of the world.

Furthermore, the idea that China only produces cheap products is no longer true. In fact, for medium to high-quality clothing, China offers the best value for money. Manufacturers have invested significantly in modern technology, such as automated cutting machines, which ensures that sizes and stitching are consistent. This level of quality often exceeds what is found in regions that rely more on manual labor. For fashion brands, this means they can get better materials and workmanship for their money, making China the best place for premium garment production.

Ready to start your line? Contact us for a sample.